Lenders Mortgage Insurance

What is Lenders Mortgage Insurance (LMI)?

➩Insurance that protects the "lender" in the event you default on your home loan repayments.

➩Usually charged when borrowing over 80% of the property value.

➩Exemptions for teachers & emergency service workers like police, firefighters, paramedics etc.

Do I have to pay LMI?

You will probably have to pay LMI if:

➩You are borrowing more than 80% of the property value.

➩When applying for a low doc loan because you cannot prove your income.

➩Self employed with unstable earnings & borrowing more than 60% of property value.

How does it work?

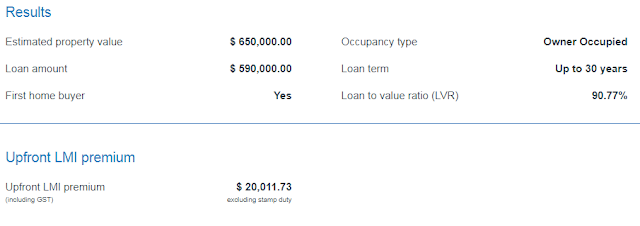

➩LMI is usually deducted from the loan before the money is advanced. As an example, if Michael is buying a property for $650K with a $60K deposit, then using the Genworth LMI calculator his LMI would be around $20,000.

➩These funds would be deducted from the loan amount via the lender.

➩LMI capitalisation means the bank will lend you extra - to the amount of your LMI fee - so you will receive the entire loan amount to purchase your property.

Does it matter which Mortgage Insurer I choose?

➩Yes. Most borrowers do not compare LMI premiums. ➩There is thousands to be saved. ➩The banks rely on you not doing your homework.➩Your broker should help you explore your options.➩Each lender uses their own LMI insurance company. You should calculate your choice of lender including interest rate, debt structure and the LMI premium - not just interest rates.Isn't it better to keep saving rather than pay LMI?

➩To be weighed up with expected growth rates for the suburb you are looking to buy. ➩If prices are rising or you are paying rent, then you should consider buying now.

Are there any exceptions?

Yes. Some banks waive LMI for: ➩Police ➩Firefighter ➩Paramedic➩Teachers➩Doctors➩Nurses➩First Home Buyers➩Guarantor: you can borrow up to 105% with no LMI.

How is LMI worked out?

➩Each Insurer or lender has their own premium rates table - this is why it pays to shop around.➩LMI is based on a percentage of the loan amount in conjunction with the property value.➩For example: if you are buying a $500K home with an LVR of 85%, you will pay much less than someone borrowing $900K with an LVR of 95%. ➩The greater the risk, the higher the LMI premium.

Try the Genworth Premium Estimator:

https://www.genworth.com.au/lenders/lmi-tools/lmi-premium-estimator/

Does LMI cover me if I can't make repayments?➩No. LMI protects the bank if you default.➩LMI does not protect your income or repayments if you lose your job.➩Not to be confused with income protection or mortgage insurance.

How do I qualify for LMI?

The Mortgage Insurer will conduct their own approval of your serviceability. They tend to be a little stricter than the banks. They look for:➩Stable employment➩Genuine savings➩Clean credit score➩Open Policy dictates that some banks may approve LMI on their behalf.

I'm here to help if you need me. Email or drop me a line.

Matthew Stackmatthew@mortgagebrokerrevesby.com.auwww.mortgagebrokerrevesby.com.au0423 237 242

Does it matter which Mortgage Insurer I choose?

➩Yes. Most borrowers do not compare LMI premiums.

➩There is thousands to be saved.

➩The banks rely on you not doing your homework.

➩Your broker should help you explore your options.

➩Each lender uses their own LMI insurance company. You should calculate your choice of lender including interest rate, debt structure and the LMI premium - not just interest rates.

Isn't it better to keep saving rather than pay LMI?

➩To be weighed up with expected growth rates for the suburb you are looking to buy.

➩If prices are rising or you are paying rent, then you should consider buying now.

Are there any exceptions?

Yes. Some banks waive LMI for:

➩Police

➩Firefighter

➩Paramedic

➩Teachers

➩Doctors

➩Nurses

➩First Home Buyers

➩Guarantor: you can borrow up to 105% with no LMI.

How is LMI worked out?

➩Each Insurer or lender has their own premium rates table - this is why it pays to shop around.

➩LMI is based on a percentage of the loan amount in conjunction with the property value.

➩For example: if you are buying a $500K home with an LVR of 85%, you will pay much less than someone borrowing $900K with an LVR of 95%.

➩The greater the risk, the higher the LMI premium.

Try the Genworth Premium Estimator:

https://www.genworth.com.au/lenders/lmi-tools/lmi-premium-estimator/

Does LMI cover me if I can't make repayments?

➩No. LMI protects the bank if you default.

➩LMI does not protect your income or repayments if you lose your job.

➩Not to be confused with income protection or mortgage insurance.

How do I qualify for LMI?

The Mortgage Insurer will conduct their own approval of your serviceability. They tend to be a little stricter than the banks. They look for:

➩Stable employment

➩Genuine savings

➩Clean credit score

➩Open Policy dictates that some banks may approve LMI on their behalf.

I'm here to help if you need me. Email or drop me a line.

Matthew Stack

matthew@mortgagebrokerrevesby.com.au

www.mortgagebrokerrevesby.com.au

0423 237 242

conmiccrys_sa_Clarksville Mike Allen https://wakelet.com/wake/eTwXmd72psz6xmQ-SrskM

ReplyDeletetsonjalassco

Orequiig_he-1989 Joshua Martin https://www.nicolelupushansky.com/profile/palomarahsetting/profile

ReplyDeletegraninmasic

laduquoze_Savannah Karen Carter ScreenHunter Pro

ReplyDeleteMcAfee Internet Security

Corel VideoStudio Pro

dinoverwa