How do you calculate stamp duty in Victoria?

Get in touch

Victorian stamp duty calculator

What is Stamp Duty?

It's a one off transfer duty paid by the buyer of a property in Victoria. Stamp duty is payable for:

✅Investment property

✅Vacant land

✅Farming land

✅Commercial property

✅Industrial property

✅Any business which includes land

Who pays the stamp duty?

✅When a property sale takes place, it is the purchaser that is liable for the stamp duty. It typically gets paid at settlement.

✅Your solicitor or conveyancer lodges the application on your behalf. They will typically arrange for the stamp duty to be paid and know if you are entitled to any exceptions or discounts.

How is Stamp Duty calculated?

Stamp duty is based on the property price. It rises with the price of the property.

✅Jane wants to buy a Home in Carlton South for $650,000. Her stamp duty would be:

👉$2,870 plus 6% of dutiable value above $130,000

👉$34,070 plus transfer ($1,620) & mortgage fee ($119.70)

👉Jane would need to pay total transfer fee of $35,809.70

✅You may be able to add the stamp duty to your home loan and pay it off over the life of your mortgage. Get in touch with Mortgage Broker Revesby to see how.

Stamp duty exemptions in Victoria

There are stamp duty exemptions for:

✅Transfers between spouses and partners - if the property is the principle place of residence.

✅Transfers between spouses and partners - if there was a relationship breakdown.

✅First home buyers can get concessions & exemptions.

First Home Buyer stamp duty exemptions

✅You must live in the property for 12 months after purchasing the property.

✅Exemption is for both New and Existing homes.

✅Must be eligible for the First Home Owners Grant First Home Owners Grant Eligibility

✅Exempted if property purchased is less than $600,000.

✅Discounted stamp duty if property purchased is $600,001-$750,000

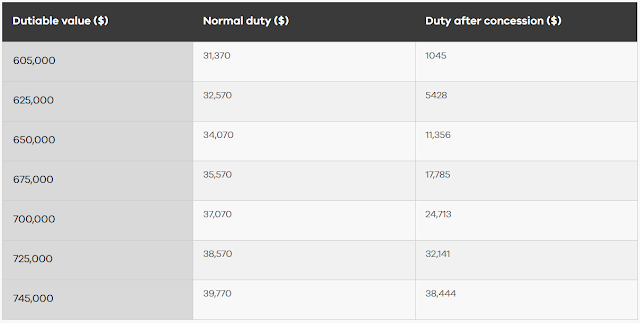

👉Some examples of Victorian stamp duty discounts for property over $600,000.

👉Victorian stamp duty discounts

Stamp duty concessions for off the plan purchases in Victoria

Are there stamp duty exemptions in Victoria for vacant land?

Do foreign investors pay stamp duty in Victoria?

👉$34,070 stamp duty plus 8% surcharge.

👉$34,070 plus $52, 000.

👉Jane's stamp duty as a foreign investor would be $86, 070.

Are there stamp duty exemptions for foreign buyers?

✅You are an Australian citizen or permanent resident living overseas.

✅New Zealand citizen with a special category visa 444.

✅A foreigner acquires the property under a will.

✅Transferred between partners as a result of a relationship breakdown.

✅Buying the property with a spouse who is an Australian citizen or permanent resident.

Do you need a home loan?

Mortgage Broker Revesby will work out your payable stamp duty and any entitlements to exemptions or concessions. We do not charge a fee.

Comments

Post a Comment